Say cheese! Dental Insurance for freelancers

Are you a freelancer or self-employed individual looking for affordable dental insurance? Well, say cheese because we’ve got you covered! Taking care of your oral health is important, and having the right insurance can make it easy and affordable. In this article, we’ll explore how you can get the dental coverage you need as a freelancer or self-employed person.

Image Source: slideteam.net

One of the biggest challenges for freelancers and self-employed individuals is finding affordable Health Insurance, including dental coverage. Many traditional insurance plans offered through employers may not be an option for those who work for themselves. However, there are still plenty of options available to ensure that you can keep your pearly whites in tip-top shape.

One option for dental insurance for freelancers is to purchase a standalone dental insurance plan. These plans are specifically designed to provide coverage for dental procedures and services. They can be purchased on their own or in addition to a health insurance plan, depending on your needs and budget.

Image Source: investopedia.com

Another option for self-employed individuals is to look into dental discount plans. These plans offer discounted rates on dental services at participating providers. While they are not insurance, they can still help you save money on routine cleanings, fillings, and other dental procedures.

If you’re a freelancer or self-employed individual who travels frequently, you may want to consider a dental insurance plan that offers coverage nationwide. This can be especially useful if you need to visit a dentist while away from Home. Make sure to check the network of providers included in the plan to ensure that you have access to dental care wherever you go.

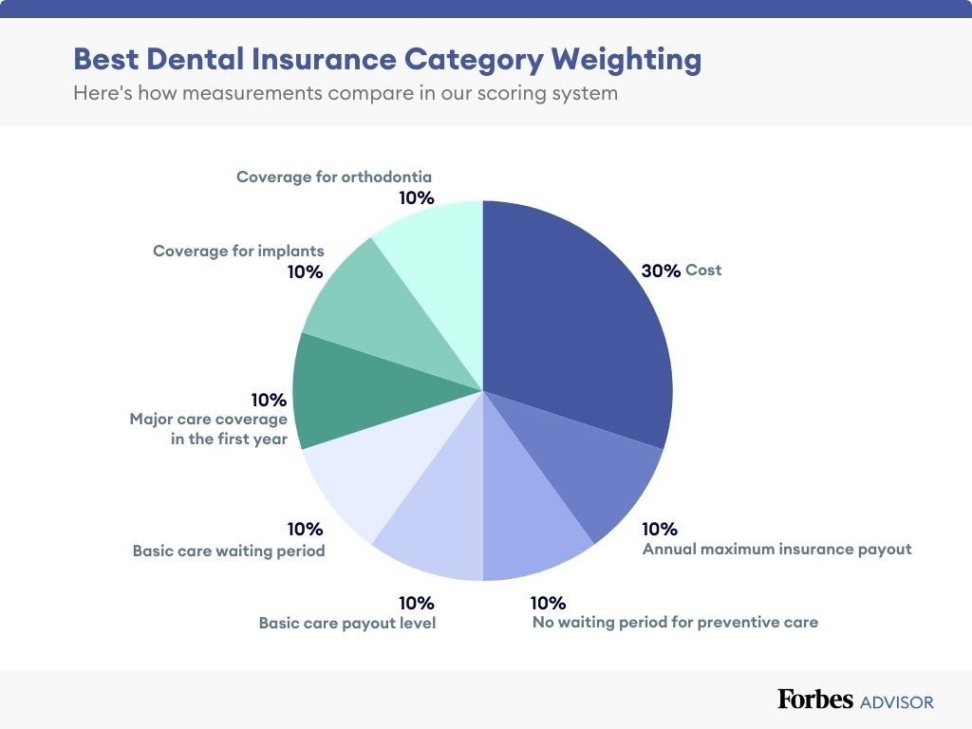

Image Source: ytimg.com

When shopping for dental insurance as a freelancer, it’s important to consider your budget and dental care needs. Some plans may have higher premiums but offer more comprehensive coverage, while others may have lower premiums but cover only basic services. Take the time to compare different plans and choose one that fits your needs and budget.

In addition to regular dental insurance, freelancers and self-employed individuals may also want to look into health savings accounts (HSAs) or flexible spending accounts (FSAs) that can be used to pay for dental expenses. These accounts allow you to set aside pre-tax dollars for medical and dental costs, providing a tax-advantaged way to save money on healthcare.

Image Source: forbes.com

No matter which option you choose, it’s important to prioritize your oral health as a freelancer or self-employed individual. Regular dental check-ups and cleanings can help prevent costly dental problems down the road. By investing in dental insurance, you can ensure that you have access to quality dental care when you need it most.

So, say cheese and smile bright knowing that you have the dental insurance coverage you need as a freelancer or self-employed individual. With the right plan in place, you can keep your pearly whites in tip-top shape without breaking the bank. Get covered and take care of your oral health today!

Smile Bright with Easy Dental Coverage

Image Source: momentumplans.com

Are you a self-employed individual looking to protect your pearly whites without breaking the bank? Look no further, because we’ve got you covered! Dental Insurance for freelancers and self-employed folks has never been easier to obtain. With a wide range of options available, you can find a plan that fits your needs and budget, ensuring that your smile stays bright and healthy for years to come.

One of the biggest challenges for self-employed individuals is finding affordable health and dental insurance. Many traditional employers offer dental coverage as part of their benefits package, but when you’re working for yourself, you’re on your own. Thankfully, there are now more options than ever for self-employed individuals to get the dental coverage they need without breaking the bank.

Image Source: askthedentist.com

Whether you’re a freelance writer, a small business owner, or a gig economy worker, having dental insurance is crucial for maintaining your oral health. Regular dental check-ups and cleanings can help prevent cavities, gum disease, and other oral health issues, saving you time and money in the long run. With easy dental coverage options available, there’s no reason to put off taking care of your teeth any longer.

When looking for dental insurance as a self-employed individual, it’s important to consider your specific needs and budget. There are a variety of plans available, ranging from basic coverage for preventive care to more comprehensive plans that cover major procedures. By doing some research and comparing different options, you can find a plan that works for you and your wallet.

Many insurance companies now offer online tools that make it easy to compare plans and get quotes quickly and easily. You can enter some basic information about yourself and your dental needs, and the tool will generate a list of plans that meet your criteria. This makes it simple to find the right coverage without spending hours on the phone or visiting multiple websites.

In addition to traditional dental insurance plans, there are also alternative options available for self-employed individuals. Discount dental plans, for example, offer reduced rates on dental services in exchange for a monthly or annual membership fee. While these plans may not cover as much as traditional insurance, they can be a cost-effective option for those looking to save money on their dental care.

Another option to consider is a health savings account (HSA) or flexible spending account (FSA) that can be used to pay for dental expenses. These accounts allow you to set aside pre-tax dollars for medical and dental costs, saving you money on out-of-pocket expenses. By taking advantage of these accounts, you can make your dental care more affordable and accessible.

No matter which option you choose, the most important thing is to prioritize your oral health and make sure you have the coverage you need. Your smile is one of the first things people notice about you, so it’s important to take care of it. With easy dental coverage options available for self-employed individuals, there’s no excuse not to get the care you need to keep your smile bright and healthy.

Self-employed? Here’s how to get covered

Are you a self-employed individual looking to protect your pearly whites with Dental Insurance? Well, you’re in luck! In this article, we will explore how easy it is for freelancers and other self-employed folks to get the coverage they need to keep their smiles bright and healthy.

Being self-employed comes with many perks, such as setting your own schedule and being your own boss. However, one downside is that you are responsible for finding and paying for your own dental insurance. But fret not, as there are plenty of options out there to make this process easy and affordable.

First and foremost, it’s important to understand the importance of dental insurance. Regular dental check-ups are crucial for maintaining good oral health and catching any potential issues early on. By having dental insurance, you can save money on these routine visits and any necessary treatments that may arise.

One of the easiest ways for self-employed individuals to get dental insurance is through the Health Insurance Marketplace. The Marketplace offers a variety of dental plans that cater to different needs and budgets. You can compare different plans side by side and choose the one that best fits your needs.

Another option to consider is joining a professional organization or association that offers group dental insurance plans to its members. This can be a great way to access affordable coverage while also networking with other like-minded individuals in your field.

If neither of these options works for you, don’t worry – there are still plenty of individual dental insurance plans available for self-employed individuals. Many insurance companies offer standalone dental plans that you can purchase directly from them. These plans vary in coverage and cost, so be sure to shop around and compare different options before making a decision.

Additionally, some dental discount plans are also available for self-employed individuals. While not technically insurance, these plans offer discounted rates on dental services at participating providers. This can be a good option for those who don’t want to commit to a traditional insurance plan but still want to save money on dental care.

In addition to traditional dental insurance, some self-employed individuals may also be eligible for Medicaid or the Children’s Health Insurance Program (CHIP) if they meet certain income requirements. These programs offer dental coverage for qualifying individuals and can be a great option for those who may not be able to afford traditional insurance.

Ultimately, the key to getting covered with dental insurance as a self-employed individual is to do your research and explore all of the available options. Don’t be afraid to ask questions and seek out help from insurance brokers or healthcare navigators if needed. Your smile is worth it!

So, if you’re self-employed and in need of dental insurance, don’t wait any longer – get covered today and keep your pearly whites in tip-top shape! Your smile will thank you for it.

Keep your Pearly Whites in Tip-Top Shape

Are you a self-employed individual who values the importance of maintaining a healthy smile? As a freelancer, it can be easy to overlook the necessity of Dental Insurance in your overall health and wellness plan. However, taking care of your teeth is crucial not only for your oral health but also for your overall well-being. In this article, we will explore how you can keep your pearly whites in tip-top shape by getting the right dental insurance coverage tailored to your self-employed lifestyle.

As a freelancer, you may not have access to a traditional employee benefits package that includes dental insurance. This can make it challenging to prioritize your dental health when you are solely responsible for finding and paying for your own coverage. However, there are a variety of options available to self-employed individuals like yourself that can make getting dental insurance easy and affordable.

One option to consider is purchasing a standalone dental insurance plan specifically designed for freelancers and self-employed individuals. These plans typically offer comprehensive coverage for routine dental care, such as cleanings, exams, and x-rays, as well as coverage for more extensive procedures like fillings, crowns, and root canals. By investing in a dental insurance plan, you can ensure that you have access to the care you need to keep your teeth and gums healthy.

Another option to explore is joining a Health Insurance marketplace or exchange where you can shop for dental insurance plans alongside other health insurance options. These marketplaces often offer a variety of plans from different insurance providers, allowing you to compare coverage options and costs to find the best plan for your needs. By shopping through a health insurance marketplace, you can easily find a dental insurance plan that fits your budget and provides the coverage you need to maintain your oral health.

In addition to standalone dental insurance plans and health insurance marketplaces, you may also have the option to purchase dental discount plans as a self-employed individual. These plans are not insurance but rather a membership program that provides discounts on dental services when you visit participating dentists. While dental discount plans do not provide the same level of coverage as traditional insurance plans, they can be a cost-effective option for freelancers looking to save money on their dental care.

No matter which option you choose, having dental insurance as a self-employed individual is essential for keeping your pearly whites in tip-top shape. Regular dental check-ups and cleanings are key to preventing oral health problems and catching any issues early before they become more serious and costly to treat. By investing in dental insurance, you can have peace of mind knowing that you have the coverage you need to maintain a healthy smile.

So, don’t let being self-employed stand in the way of prioritizing your dental health. With the right dental insurance coverage, you can keep your pearly whites in tip-top shape and ensure that your smile shines bright for years to come. Take the time to explore your options and find a plan that works for you as a freelancer – your teeth will thank you!

dental insurance for self-employed